-

- How to use family guarantee

- Share or sell

- Refinancing and you will family collateral loans

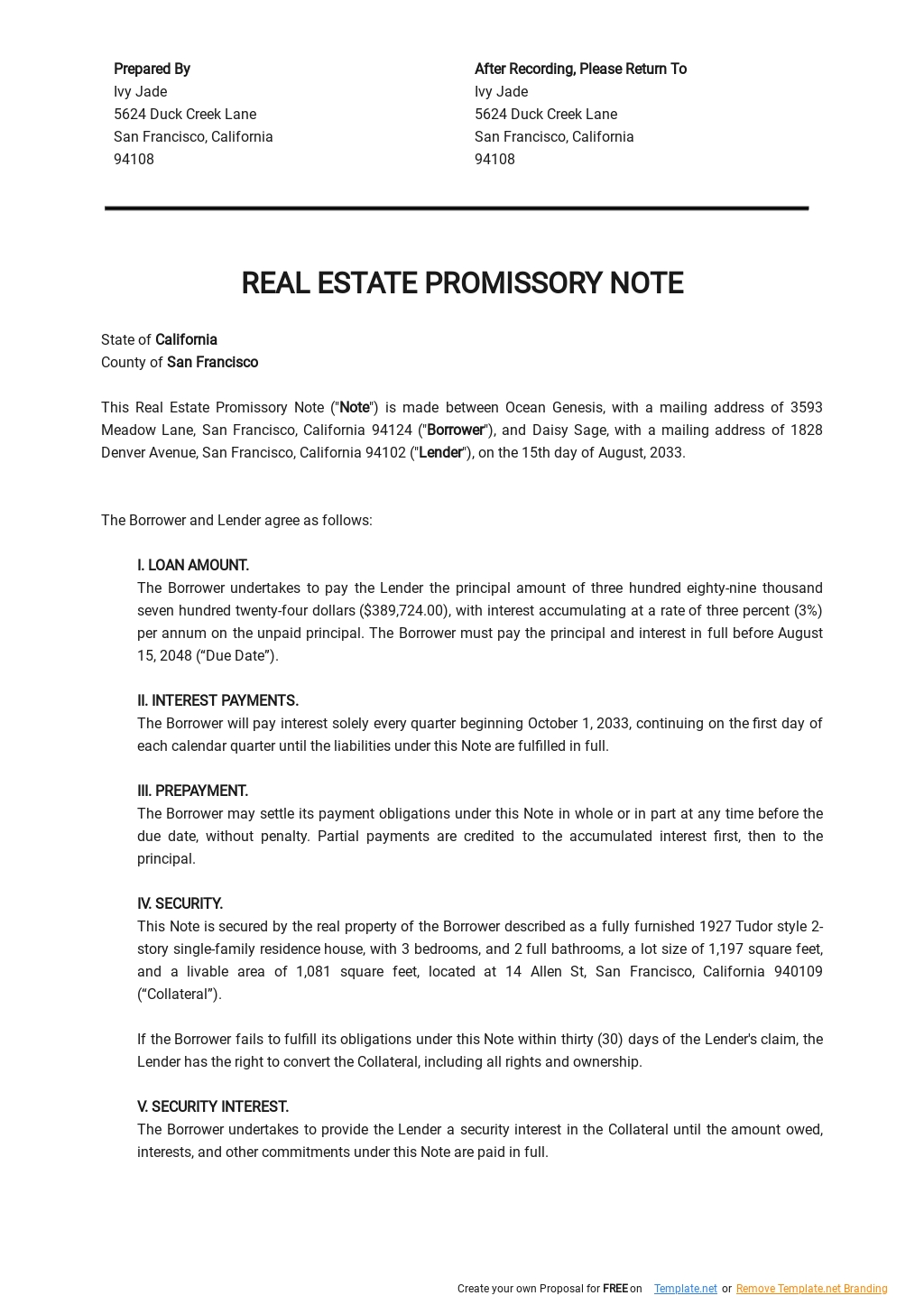

More than 70% off older Us citizens imagine their property many valuable advantage they own. For almost all young Us citizens, the home signifies a great deal of solutions. Throughout a divorce or separation, you should decide what to do with one property.

Your property guarantee stands for what your residence is worth instead of exactly what you borrowed from inside the fund, along with one another mortgages and you may domestic security money. That it shape might possibly be an important part of your divorce case conversations together with your companion.

The way you use home guarantee through the a divorce or separation payment

A number of claims, and California, issues bought during the matrimony are thought public, definition they have to be split up inside divorce process unless of course one another parties arrive at a different equitable arrangement. For many individuals, home security is the largest advantage to split.

- Offer our house and you will split the gains equally.

- Buy your companion and maintain the house.

- Trade almost every other rewarding property together with your mate to save our house.

For every single alternative is sold with pros and cons. Such as for example, you could potentially regret promoting a house if you’re in the a rigid markets having not any other possibilities. However, this is simply not a choice you might avoid. Within your divorce, you must determine what related to which really worthwhile house.

Understand exactly how your residence equity can be put on the divorce case, you desire research. Go after such measures to choose exactly what highway is right for you.

1. Get a keen appraiser

Professional appraisers walk through your house and you will property, explaining the specific benefits and drawbacks of your property whilst is good now. The information and knowledge you have made regarding a keen appraiser is far more real than the home worthy of you notice into assets tax statements. Appraisers envision exactly how much your residence is value for folks who would be to sell it today.

An assessment can cost as little as $313 to own just one-home. You and your partner you will display this expenses, or you could carry it to the individually to track down guidance to own your own breakup settlement bundle.

2. Dictate the real equity

Keep in mind that your house collateral ‘s the difference between exactly what your residence is worth and what you owe. An appraisal provides you with only 1 / 2 of which equation.

Start by the financial. An average American user features more than $two hundred,000 inside the financial obligations, even when your own personal you’ll differ. Determine your balance, and have the firm regarding very early termination costs. If you’d get slapped which have a superb to have paying the equilibrium via your divorce or separation, one to matter will be go into your own computations.

Residents use home collateral financing otherwise household equity credit lines (HELOCs) to pay for fixes, getaways, and more. A good HELOC allows visitors to acquire up to 85% of one’s home’s worthy of. These materials increased inside popularity in 2022.

A high mortgage equilibrium and significant HELOC you will definitely indicate your residence is really worth little or no on your settlement. On the other hand, you may be astonished at brand new power you have got on the divorce proceedings using this one to most rewarding house.

step three. Evaluate your financial balance

To store a great mortgaged household, you should look for a partner happy to pay the existing tool and give you yet another one in your own title merely. Usually your credit rating last to analysis? Would you build a solamente mortgage payment?

cuatro. Assess your own market

Whenever you pay money for your house since an unicamente holder, do you wish to stay-in they? A house you shared with your partner was filled with bland thoughts you’d rather forget. Doing new you are going to make you a resume, but it you’ll involve thinking of moving a unique community otherwise state.

Contact a real estate agent your faith, and take a glance at a number of attributes available in the fresh new marketplace. If you fail to come across some thing suitable, staying set would-be wise.

Refinancing and domestic security finance

You have spoke together with your spouse, and you may you have selected in which to stay the home your shortly after mutual. Just what are your options?

- Repay the old mortgage

- Give you an alternative financial on your name

- Write a check for the essential difference between the 2 fund

One to latest have a look at represents your own payout with the partner within the divorce or separation settlement. Your disappear with a brand new mortgage on your own name and you will liberty from the lover.

If your have a look at try small, you are able to in the huge difference giving your ex lover things of equivalent really worth, for instance the household members auto, watercraft, otherwise vacation family.

Some individuals explore HELOCs otherwise household security financing to make up the difference in a separation settlement. Unfortunately, this does not eradicate him or her throughout the residence’s certified identity. You happen to be both into hook up to own home loan repayments and you will HELOC costs. If you would like a flush crack in divorce, this is not the best route for you.

Seeking a home loan spouse would be not too difficult, especially if you have a very good credit rating. Nonbanks, for example Skyrocket Mortgage and you will LoanDepot, concentrate on factors designed for homeowners, as well as approved more one or two-thirds of all the mortgage loans during the 2020. A company similar to this could point an effective preapproval for a financial loan in minutes, allowing you to hold advised talks together with your partner.

No choice is naturally proper or wrong. You and your partner can choose if the remaining our home is most readily useful or if perhaps selling is most beneficial for everybody with it.

Its a choice you’ll need to arrived at to one another, that have or without having any help of external guidance. A divorce proceedings mediator makes it possible to come to a decision easier and you can affordably than simply for people who rented a lawyer.