-

When you find yourself notice-employed while want it property, your submit a comparable mortgage app just like the everybody. Financial L lenders contemplate a similar anything when you are good self-working debtor: your credit rating, just how much personal debt you have got, the possessions along with your money.

Thus what’s other? Once you benefit anyone else, loan providers visit your boss to ensure extent and you will records of this income , as well as how almost certainly it is you are able to continue generating it. When you find yourself worry about-employed, you need to provide the needed files to verify you to definitely your income try steady.

Qualifying For Home financing When you’re Notice-Functioning

For folks who work with yourself, you’re probably currently regularly being required to be more organized and you may monitoring your revenue. That can help when it’s time for you submit an application for a mortgage, and thus will so it breakdown of what to see as well as how to prepare.

Preciselywhat are Mortgage lenders Looking?

- Income balances

- The location and you will nature of the mind-a career

- The fresh new financial fuel of business

- The art of your business to generate enough earnings regarding the upcoming

Just what Data files Do you wish to Give?

To begin with the home to shop for procedure, you will need a history of continuous worry about-a career income, constantly for around couple of years. Below are a few types of documents a lender might inquire about.

A job Verification

- Latest members

- An authorized specialized individual accountant (CPA)

- An expert business that will attest to your own membership

- One condition or team license you keep

- Proof insurance to suit your needs

Income Paperwork

Has proof of constant, legitimate income, and you are clearly one-step nearer to taking approved having a mortgage. Note that even though you make consistent currency today, your own early in the day earnings might determine your ability to obtain good loan. Their lender tend to ask for the following:

You could nevertheless rating a home loan on your own house, whether or not you’ve been notice-used in less than couple of years. Sooner, your company have to be productive for no less than twelve straight months, as well as your newest a couple of years off a career (as well as non-self-employment) should be confirmed.

In such a case, the lender may perform an out in-depth check your knowledge and you will studies to determine whether your providers is also continue a reputation balance.

Ideas to Place your Greatest Application Give

As your individual boss, you want your organization to seem their far better clients. Since an individual who desires pick a home, you need your loan application and you may economic situation to seem its better to loan providers.

Idea step one: Look at the Debt-To-Income Ratio

The debt-to-income proportion, or DTI, ‘s the percentage of the disgusting monthly money you to definitely goes toward investing your own month-to-month debts. Loan providers listen to it since the you will be a less high-risk borrower in case your DTI is actually lower. That implies you may have a great deal more budget for home financing fee.

In order to estimate your DTI, divide the month-to-month repeating obligations by your month-to-month money in advance of taxes. Changing monthly obligations such as for example utilities, property fees, market and repairs aren’t experienced debts and you can commonly taken into account whenever figuring DTI.

In the event your DTI is over fifty% therefore need to get a mortgage, run reducing your personal debt before applying.

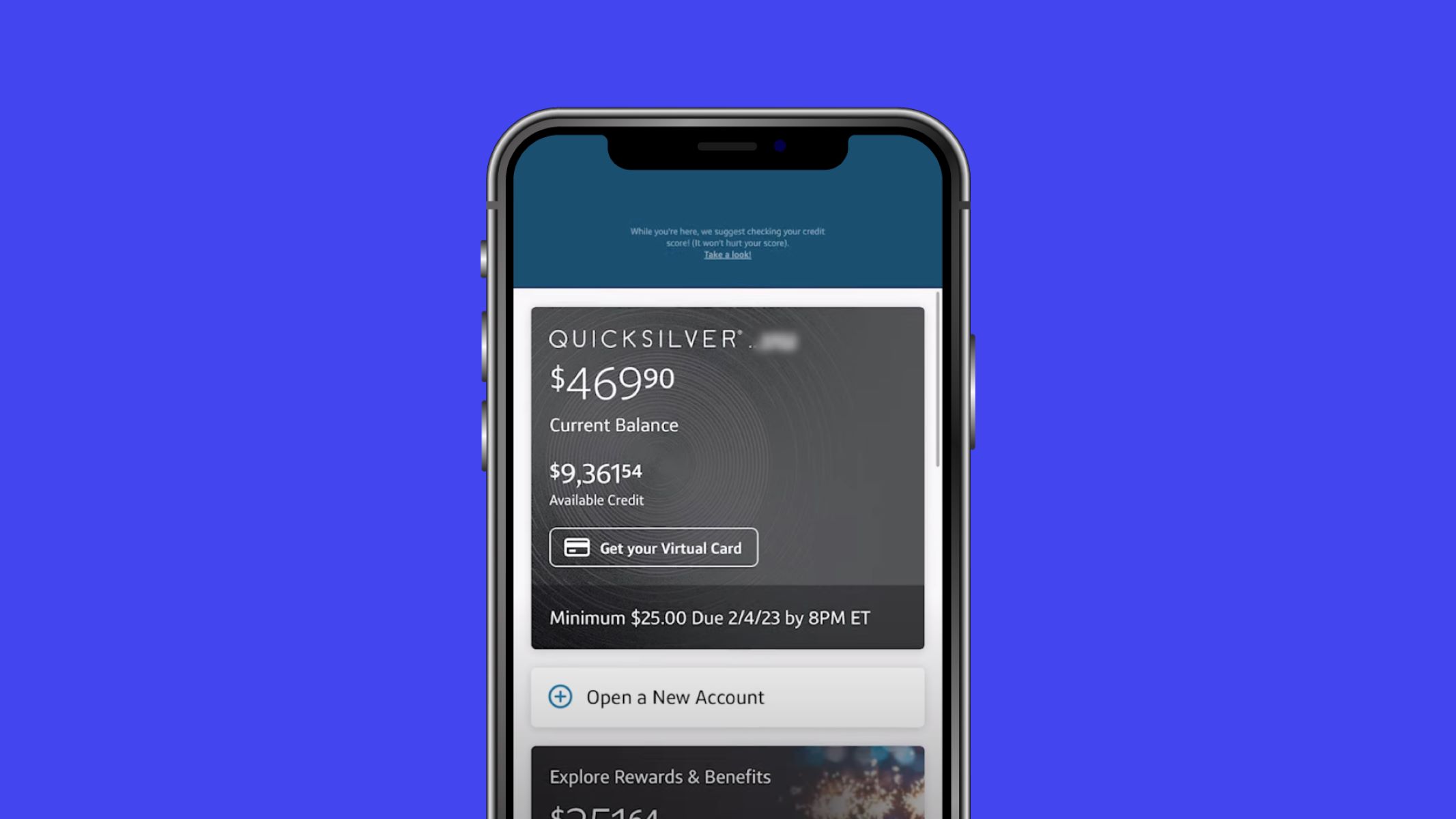

Idea dos: Keep in mind Your own Credit

Lenders check your credit history as the a sign of your own capacity Sterling Ranch loans to repay your debts. Your credit report, that’s recorded on your credit history, will not take your income into account. In lieu of their DTI, the better your credit score, more positive status you will be set for a mortgage.

Other factor towards credit score you to loan providers believe is your credit use. So it proportion strategies how much cash of your available credit you utilize.

Such as for instance, when you have a borrowing limit from $10,one hundred thousand and then have a $6,100000 equilibrium on it, their proportion try 0.sixty, or 60%. Just like your DTI, the lower the borrowing use proportion, the greater it is to suit your credit score, which means that it’s better for the home loan software.

Idea step three: Keep Team Expenditures Separate

For individuals who fees team instructions, for example a unique computers otherwise place of work provides, towards the individual credit, you are able to improve your credit use. This might has actually an awful effect on the application.

Keep company and private expenses separate by giving him or her their very own levels and handmade cards. This may hobby a more advantageous, truthful profile on the app.

The bottom line

To help you make an application for a home loan when you find yourself notice-employed, you’ll need to verify and you can document your earnings while keeping a beneficial lower DTI and higher credit score.

No matter what the a career reputation, preapproval is an essential first step in the choosing what kind of home loan is right for you. Rating preapproved having Rocket Financial now!