-

Express this short article

People that currently lent up to the maximum restoration bank mortgage maximum from $30,000, or individuals who do not want to sign up for a supplementary bank loan, can be inclined to instead grab an out in-domestic financing supplied by the interior structure agency he’s interested.

4 Recovery Enterprises with in-Family Mortgage

While this may seem like a quick and you can smoother solution at the full time, trying out for example that loan just to complete your own home improvements will get turn out to be a bad idea.

In-domestic renovation funds out-of design organizations commonly common, here are cuatro repair firms that provide inside the-domestic restoration funds during the Singapore:

Ought i need a call at-house mortgage out of renovation company?

Be mindful and prudent in it concerns delivering people mortgage. Never to move to fast, but, if you are given an in-household restoration mortgage from the indoor designer, never take it up if you do not don’t have any almost every other alternative. The following is why.

step 1. In-house loans are backed by subscribed moneylender

To begin with, why don’t we have one thing straight. So you’re able to legitimately lend profit Singapore, entities need to sign up for the best licences. Such licences are just arranged to have loan providers, particularly financial institutions, financial institutions and you can subscribed moneylenders.

Therefore, interior planning agencies is unrealistic to have the right certification so you’re able to bring unsecured loans as well as their restoration features. And for the uncommon few who do, they’re going to more than likely promote each other tracts out-of organizations while the hey, its a new source of income, so why not?

Therefore, how do home design businesses provide you with an in-family recovery redirected here mortgage? The most appropriate response is that they companion with an effective financial institution, one that is authorized in order to present personal loans with the social.

It will be possible one to an interior framework corporation get companion right up that have a lender giving its repair mortgage packages in order to customers in case you can find any available, i haven’t observed them.

However, its much more likely that people providing the loan is a licensed moneylender. Given exactly how very competitive the brand new signed up moneylending industry is, it’s not hard to consider moneylenders partnering with design firms in order to arrive at alot more potential customers.

dos. Large rates

Nothing is wrong with your interior creator providing that loan out of a licensed moneylender per se, as long as the latest moneylender was safely registered and in an effective status, it is certain from an expert and you may above-board feel.

The issue is the rate of interest billed of the signed up moneylenders is a lot more than those people recharged by the banking companies and you will boat finance companies in many cases, effortlessly outstripping their charge card interest rates!

You have to know you to definitely licensed moneylenders are allowed to charges focus of up to cuatro% 30 days compared to lender restoration fund which go to own anywhere between step 3.2% in order to cuatro.55% per year.

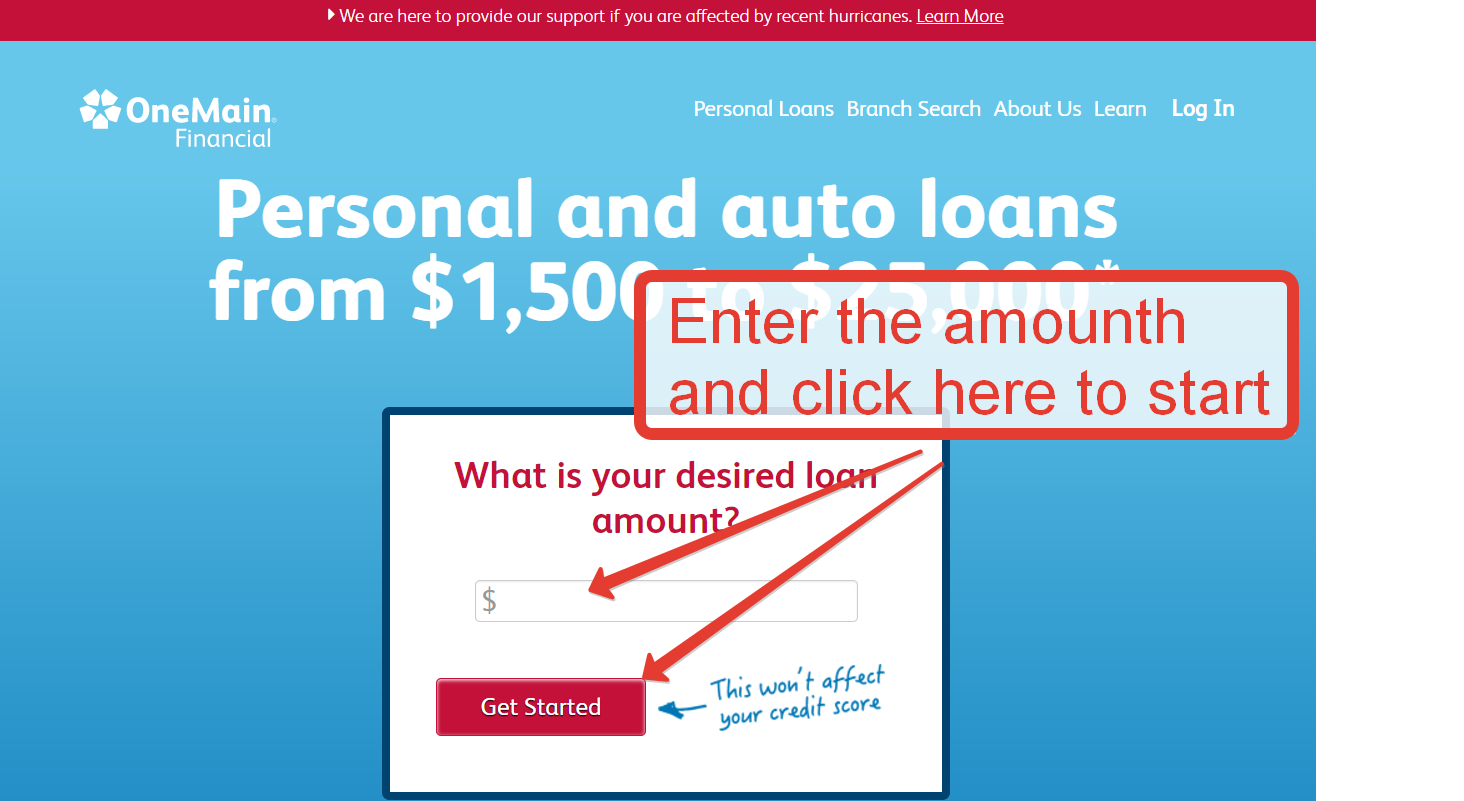

Here is an instant review ranging from an authorized moneylender loan and you may an excellent bank renovation financing, utilizing the respective providers’ on the internet calculators.

Interior Creator Within the-Home Restoration Financing

It must not be shocking, offered how well-supported the business was, having many financial and you may boat finance companies offering well listed restoration finance right here.

Get Renovation Financing inside the Singapore

Irrespective of where you take their renovation mortgage regarding – financial, licensed moneylender, or your renovation providers – you ought to be cautious about the next when considering a restoration financing provide.

step 1. Interest

Once the there is portrayed significantly more than, the pace towards a renovation loan (otherwise any borrowing, for instance) ‘s the unmarried the very first thing.

Financing with high rate of interest is more hard to repay, and also a rate that is just quite higher is also convert to a positive change inside the buck words.

2. Financing tenure

Financing period fundamentally is the big date you pay back the borrowed funds. Banking companies usually leave you step 1 to five years on exactly how to pay back your repair loan. This enables that give your debt away, leading to straight down month-to-month payments that will be simpler to perform.

But not, remember that the new expanded you are taking to expend right back, more monthly desire you are going to need to spend altogether. Although not, it is far better to choose a longer period whilst never to excess yourself.

Of numerous authorized moneylenders was reluctant to offer financing tenure offered than one year, which means your restoration loan month-to-month money will be really high possibly even bigger than you could potentially comfortably afford.

Now, if you feel that the brand new monthly premiums for your renovation mortgage is just too high, don’t get one repair mortgage, as you run the risk of shedding to your a personal debt trap, and not-stop punishment fees.

My interior creator offered me an in-household repair loan. How to proceed?

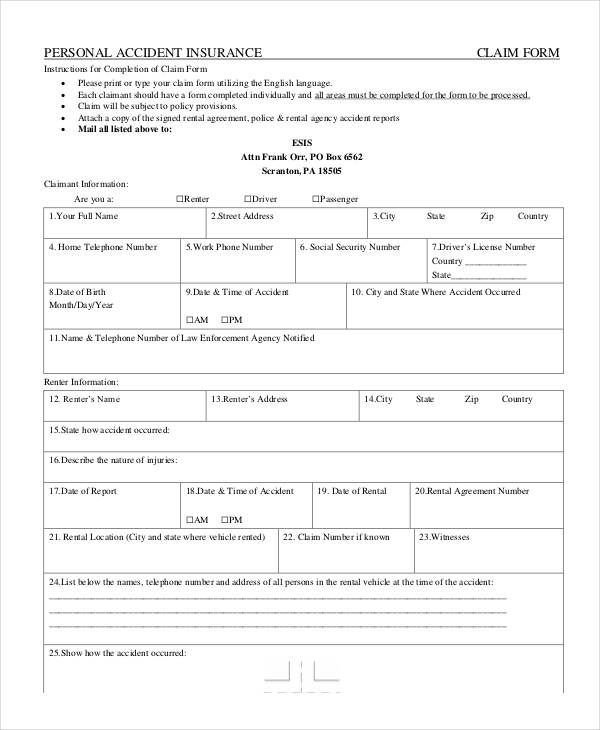

With the rare possibility your own interior creator provides a call at-domestic renovation mortgage, be sure to cautiously data the new fine print of mortgage, particularly the interest and financing cycle.

In the event your bank was good moneylender, you may want to check the Ministry of Law’s authoritative set of signed up moneylenders. Make sure brand new moneylender is not suspended otherwise blacklisted.

If you find yourself are advised that for the-domestic mortgage is out there of the a lender, don’t simply bring your interior designer’s term for this. On their own seek advice from the bank under consideration, and make certain the speed, period, charge and you may charges, or any other small print are the same.

But like i told you, in-household repair funds commonly common inside the Singapore, which means that your chances of experiencing one is likely to be low.